- Bondex Newsletter

- Posts

- BDXN: “The foundation is built. Now we scale.”

BDXN: “The foundation is built. Now we scale.”

A letter from our CEO

Most projects talk about what they're going to do. We're here to show you what we're already doing.

While other tokens hunt for product-market fit, we're scaling revenue. While they tweak tokenomics on paper, we're processing job applications from major crypto companies. While they promise future utility, we've got 5 million users and 2 million completed professional profiles.

We're moving differently because we're building infrastructure, not hype.

Upgrading the Infrastructure

We're making a significant move on the market-making side.

We're upgrading to a new institutional-grade market maker infrastructure. Better liquidity. Tighter spreads. The kind of foundation that serious projects build when they're preparing for the next phase of growth.

This isn't about quick fixes. It's about setting up the right infrastructure for scale. Projects like Movement Network and Hyperliquid invested heavily in their market-making setup after early setbacks, creating better liquidity depth and confidence that let them grow sustainably.

That's the playbook we're following. Infrastructure followed by growth.

The Buyback Commitment: Revenue Meets Value

Here's what gets us excited.

We're committed to rolling out a revenue-driven buyback program. And when we say revenue-driven, we mean it. This isn't a one-off treasury dump. This is systematic buying pressure funded by actual business revenue.

Revenue-based tokenomics are becoming the standard. Buyback programs signal sustainability, not gimmicks.

Projects showing real business models, real revenue, and real users that get attention.

Aave: $1M/week in buybacks from protocol revenue

Chainlink: $10.5M native reserve from service fees

Hyperliquid: $645M buyback commitment

These aren't moonshots. They're businesses with tokens.

That's the category we're in.

We're not competing with meme coins or AI agent tokens. We're positioning alongside serious protocols that generate and share value.

More revenue, more user rewards

Currently. Companies pay Bondex for job postings on Web3 Career, Bondex Jobs, recruitment services, and premium features. To date, over 1,000 different web3 companies have paid to post jobs on our platforms.

New revenue streams coming:

Token gating, data APIs, and ad revenue. Here's the difference, though: when you opt in to our ad network and share your data, you get rewarded through participation in the Bondex economy. LinkedIn generates billions from ads and data. Users see none of it. We're building a model where your participation has value.

That revenue doesn't just sit there. It flows into creating long-term token demand through buybacks.

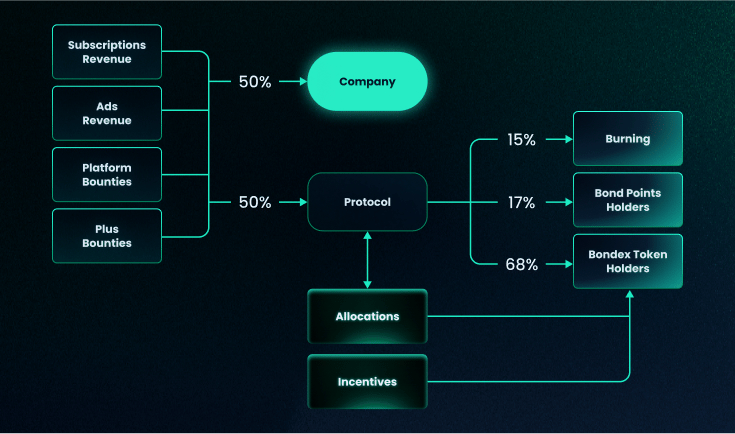

The formula: More companies using Bondex → More revenue streams activated → More revenue generated → More buying pressure created → More value flows back into the ecosystem.

Want to see how this could play out? Check out our Token Economy Simulator. Play with different growth scenarios. Adjust revenue projections across multiple streams. See how it all translates to buyback potential.

The LinkedIn Gap Nobody's Talking About

LinkedIn generates $6.4 billion annually just from premium subscriptions. Market cap? Over $200 billion.

We're building the same foundation, job postings, professional profiles, and recruitment tools, with premium tiers coming soon. But our vision goes further. Token gating. Data APIs. Ad revenue participation. Portable reputation. User ownership.

The difference? LinkedIn keeps all that value. Shareholders get rich. Users get nothing.

Meta made $68.44 per user in Q4 2023. None went to users. We monetize data too, but only with opt-in consent, and users get rewarded through participation in the Bondex economy.

We're not just rebuilding LinkedIn for web3. We're reimagining what a professional network can be when users actually own the value they create.

The Flywheel: Already Spinning

Let's talk about what we've already built.

5 million downloads. More than most web3 projects will ever see.

2 million completed profiles. Real professionals with work history, education, and resumes uploaded.

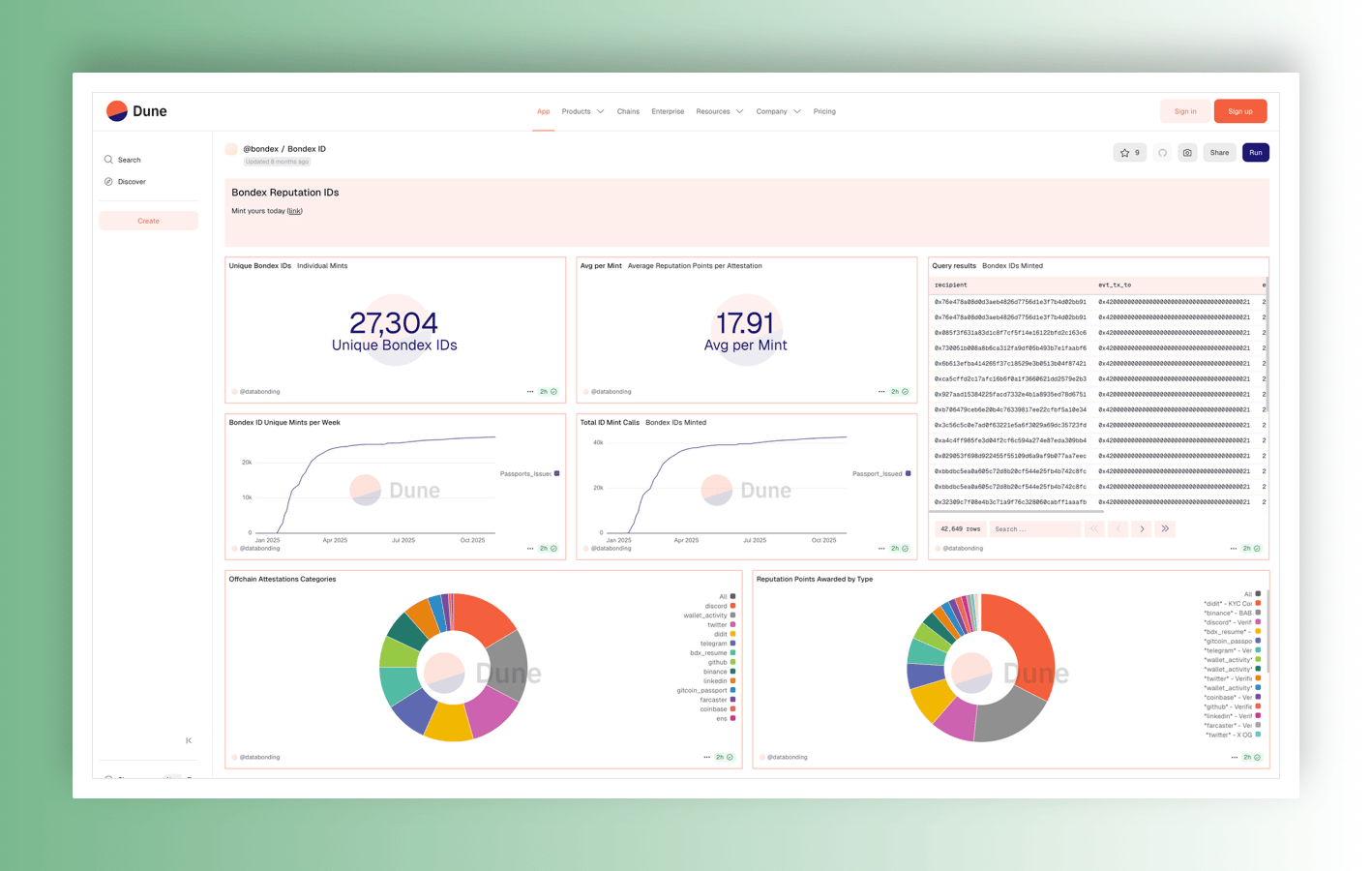

700,000 verified profiles with on-chain proof.

Nearly 30,000 minted Bondex IDs. Verifiable on-chain. See the data on our Dune dashboard.

1000+ companies using our ecosystem

The network effect is real. More users create a better talent pool. Better talent pools attract more companies. More companies generate more revenue. More revenue strengthens the token.

We're not at the beginning. We're at the inflection point.

What's Next

Users are here. Clients are tri-paying. Revenue is flowing. Infrastructure is upgraded.

Next up for Bondex is a major talent pool release, a new revenue stream announcement, expanded token utility, and a set of releases and partnerships set to make reputation your most valuable asset.

Every feature, every partnership, every job posting feeds the flywheel.

More utility → more users → more revenue → more buybacks.

LinkedIn has 900M users and a $200B market cap. The TAM is massive. We're building the web3 alternative where users actually own the value.

The foundation is built. Now we scale.

Let's build this together.

Ignacio Palomera

Co-Founder & CEO, Bondex

🔗 Connect with Bondex

X ( Twitter) | YouTube | Telegram Announcements | Telegram Group | Discord | LinkedIn | Instagram | Facebook

🟢 BDXN

Track on:

CoinGecko | CoinMarketCap